Introduction

OOPS !!! This is our main module that integrates the entire workflow into a credit union. The software thus developed covers almost all the management elements of an EMF preparing the data for a secure and standardized digitization. It elaborates on the following:

- Front Office: Cash Opening

- Front Office: Deposit and Withdrawal

- Back Office: Journal

- Back Office: Account to Account Transfer

- Loans: Setting up and monitoring loans in a smart way.

- Loans: Loan Application

Front Office

The FrontOffice includes the main operations carried out within the microfinance.

To access this menu,

go to the Treatment »FrontOffice menu.

The latter includes the following elements:

- Cashier opening

- Cash reactivation

- Cash closure

- Cash payment

- Cash withdrawal

- Background issue

- Background reception

- External fund deposit

- Collector fund outlet

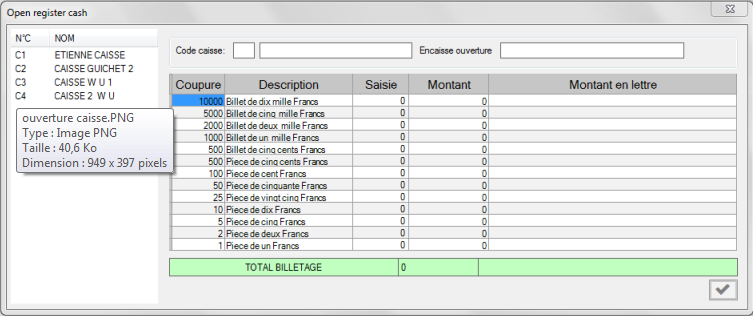

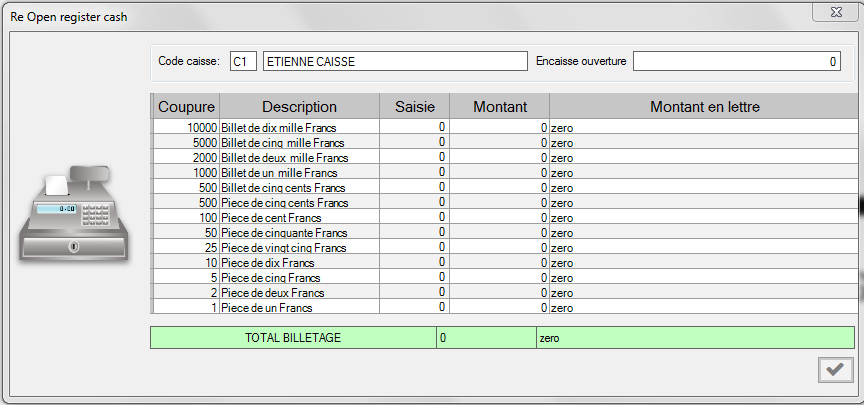

Front Office: Cash Opening

To access this menu, go to the menu Treatment »FrontOffice»

As its name indicates, this card allows you to open the cash register at the

beginning of the day. The cash register form is as follows:

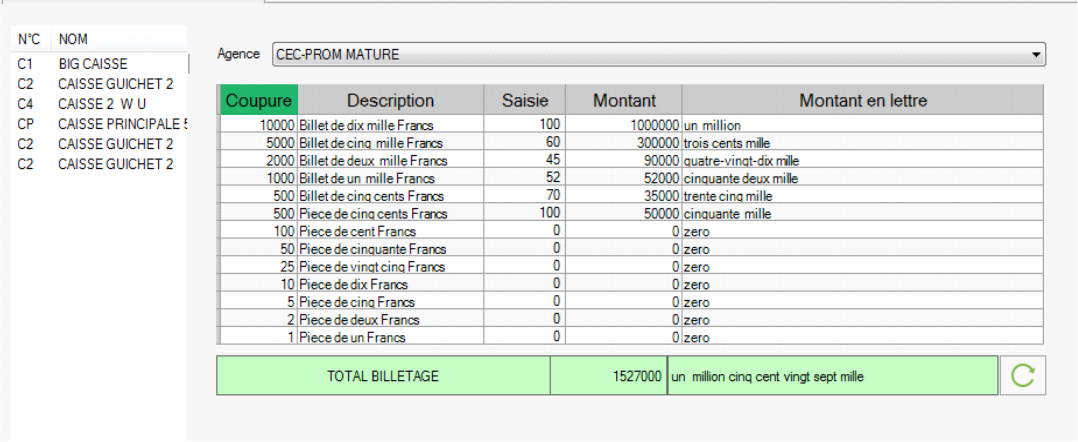

To open the Cash desk, select the name of the cash desk user.

The Bank-Notes of the Cash desk box displays the amount held in the cash desk.

Click on " ".

The following dialog box appears :

".

The following dialog box appears :

Note:

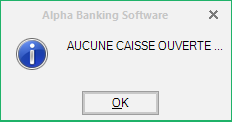

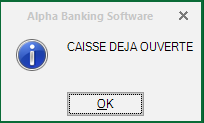

If no cash desk has been opened, the following message is displayed:

If the cash desk has already been opened, the following message is displayed:

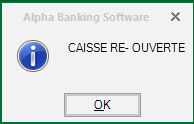

Front Office: Cash Desk Reactivation

This view allows you to reactivate a fund that has already been closed by a user.

It is important to note that only the user who has closed the checkout can reactivate it.

Click on " "

to reactivate the cash register. A dialog box appears:

"

to reactivate the cash register. A dialog box appears:

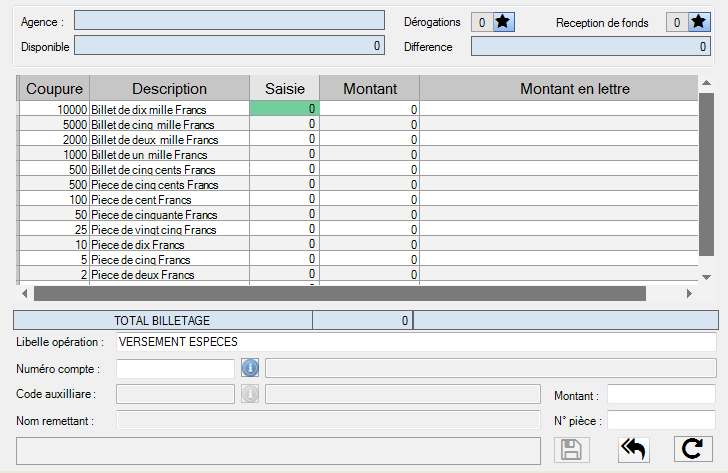

Front Office: Cash Payment

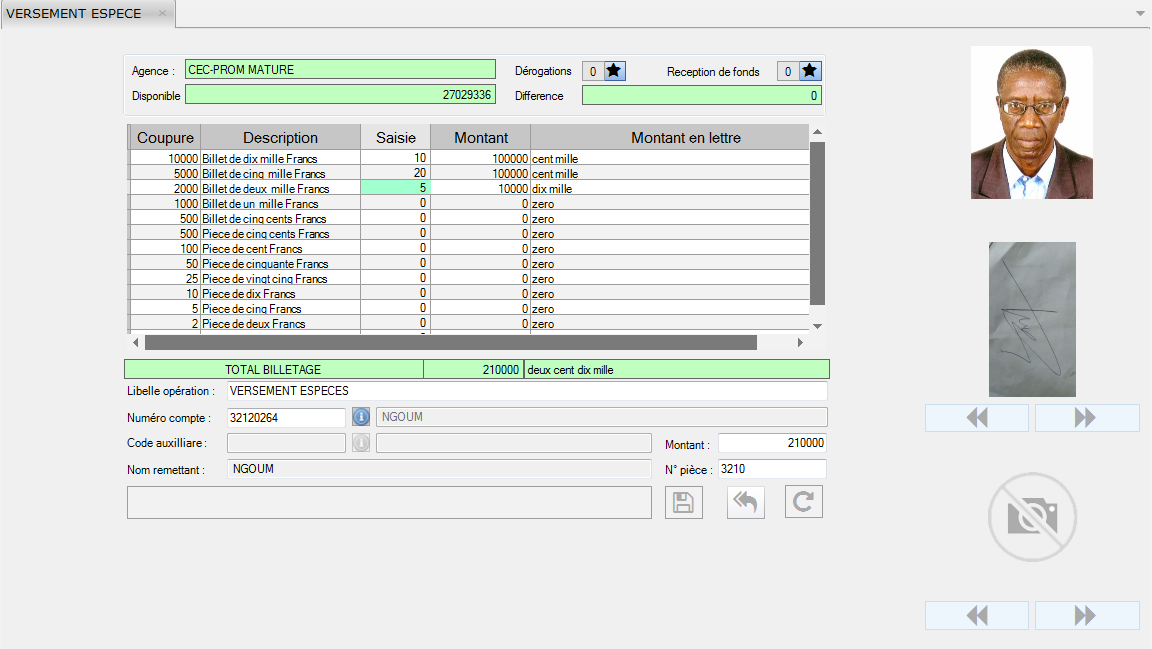

This form makes it possible to make payments in the account of the customer who immediately credits it.

It is as follows:

The user enters the account number first.

He enters the account number or

click on " ",

after which he brings the cursor into the code field and clicks the enter key.

",

after which he brings the cursor into the code field and clicks the enter key.

The following box appears:

Selects the account number by double-clicking on it.

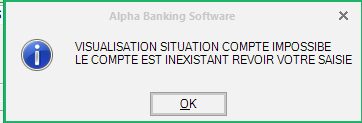

If the number of digits of the entered account number is insufficient or exceeds,

The error message below is displayed:

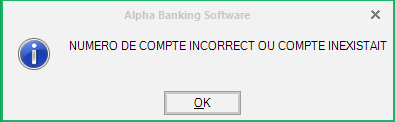

If the account number entered is wrong,

the following error message is displayed:

Once the Account Number is entered or selected, the system automatically generates

information about the account holder,

namely:

- His/her Name

- Available funds in this Account

- The number of operations in derogation: which is the process of returning an

operation when the latter is refused or is a failure. It may happen that

the customer makes a payment over the limits (click on

and select this number)

and select this number) - The number of fund receipts performed. This allows the automatic receipt of

funds between the different boxes physical intervention of the user.(click on

and select this number)

and select this number) - The auxiliary code

- The name of the remitter

- The identification image and signature of the Account holder.

After having entered this information, he/she enters:

-the series, -the amount of the payment,

-the number of the coin and

carries out the ticketing (the total of this ticketing is automatically displayed at the bottom as well as the difference at the top right).

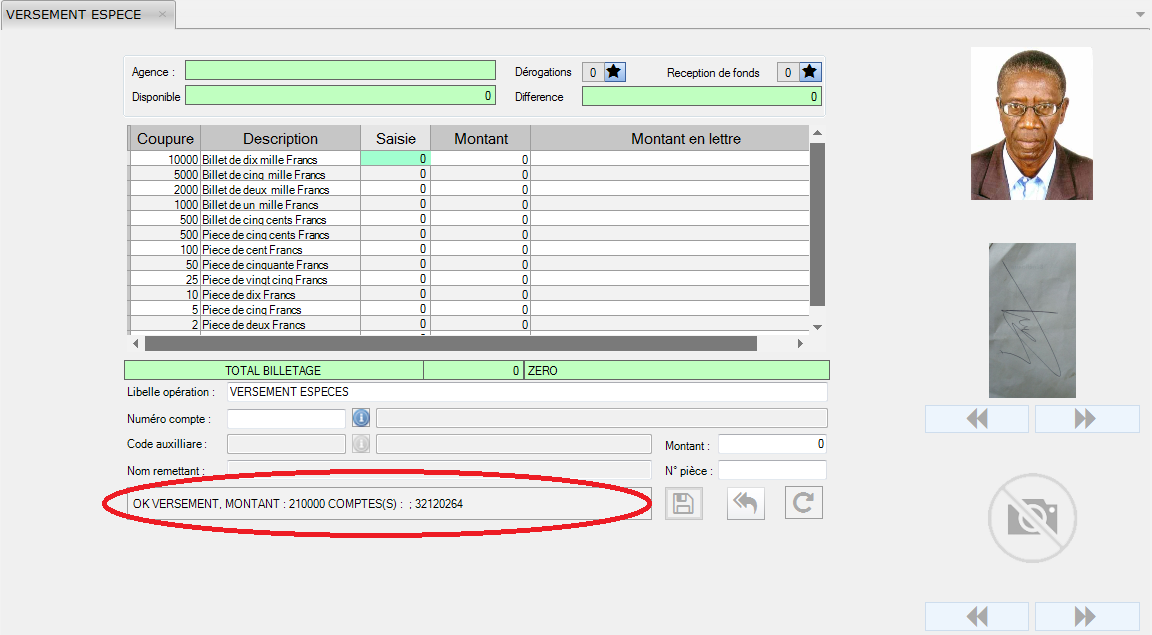

The system will credit the account chosen by the user of the sum entered.

To return to the entry, click on

and

and  to cancel the operation.

to cancel the operation. To save the payment, click on

The following card will appear:

Note: This Circle (field) indicates that the payment has been carried out successfully, as well as the "Amount paid" and "Account Number"

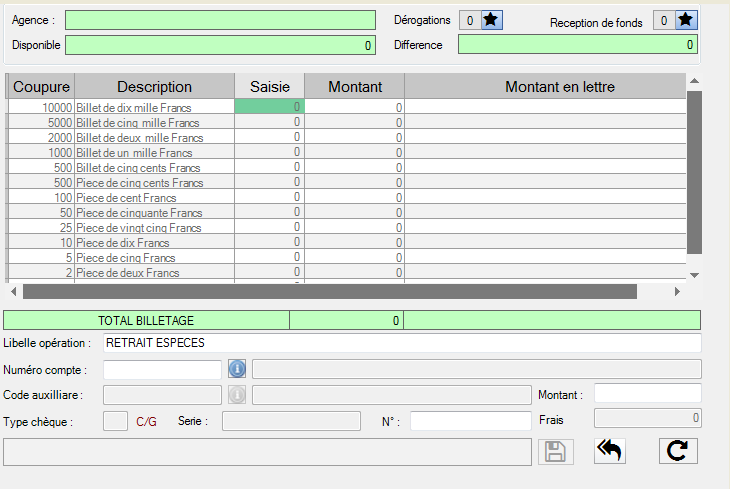

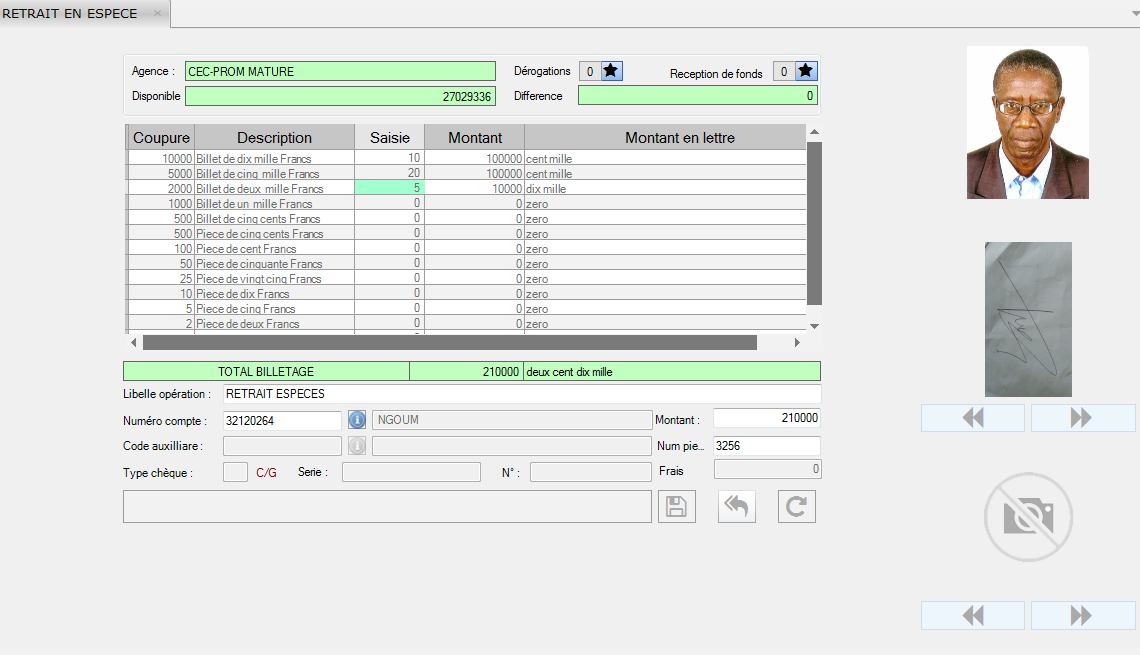

Front Office: Withdrawal

This form makes it possible to make withdrawals in the account of the customer

who immediately debit it.

This form is as follows:

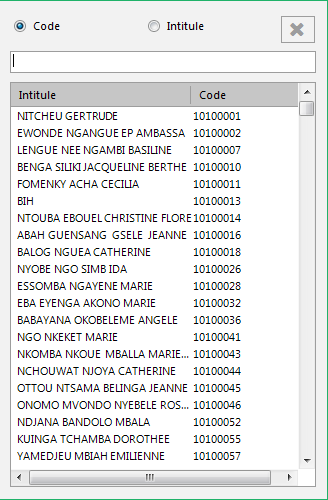

The user first enters the Account Number.

He enters the account number or

click on  ;

after which he brings the cursor into the code field and clicks the enter key.

;

after which he brings the cursor into the code field and clicks the enter key.

The following box appears:

Select the account number by double-clicking on it.

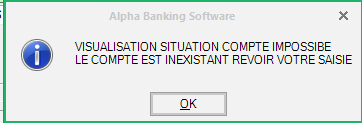

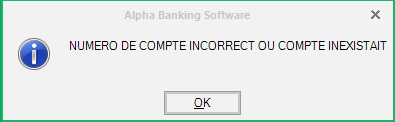

If the number of digits of the entered account number is insufficient or exceeds,

the error message below is displayed:

If the account number entered is wrong,

the following error message is displayed:

Once the account number is entered or selected, the system automatically generates

information about the account holder,

namely:

- His/her name

- The funds available in this Account

- The number of operations in derogation which is the process of returning

an operation when the latter is refused or is a failure. It may happen

that the customer makes a withdrawal greater than the amount in his account.

(click on

and select this number)

and select this number) - The number of received funds (click on

and select this number),

and select this number), - The auxiliary code

- The name of the Depositor (remitter)

- The identification image and signature of the Account holder.

After having entered this information, he/she enters

-the series,

-the amount of the payment,

the number of the coin and

-carries out the ticketing (the total of this ticketing is automatically displayed at the bottom as well as the difference at the top right).

The system will debit the account selected by the user with the sum entered.

To return to the entry, click on

and

and Clcik on

to cancel the operation.

to cancel the operation. To save the payment, click on

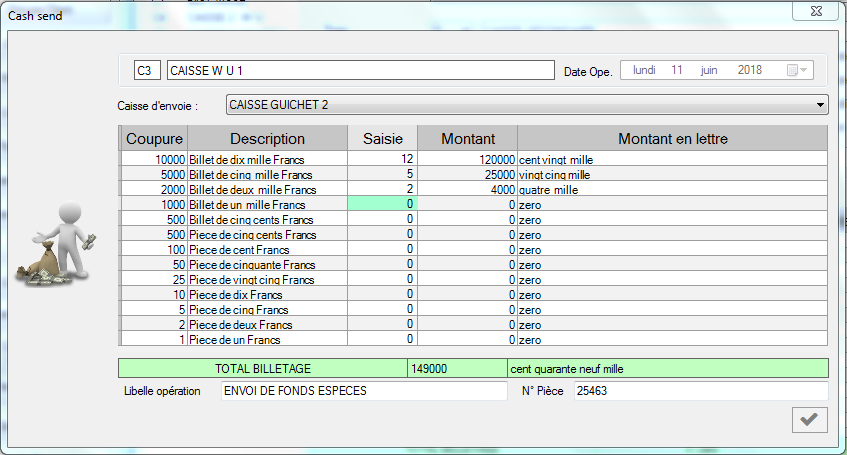

Front Office: Fund Transfer (Sending)

This form allows funds to be transferred from one cash desk to another

that does not have one.

NB: The credit union must hold a minimum of funds

necessary for the issue.

The user performs the ticketing, between the transaction name and the part number

and clicks  .

.

The system immediately performs the operation.

Front Office: Fund Transfer (Receiving)

This form allows transfered funds (funds sent), to be received by another cash-desk.

NB: It is important to note that this receipt is only possible

if the cash-desk requiring the funds must have a balance lower than the

minimum balance that a cash-desk must hold.

The user performs the ticketing, between the transaction name and the part

number and clicks  .

The system immediately performs the operation.

.

The system immediately performs the operation.

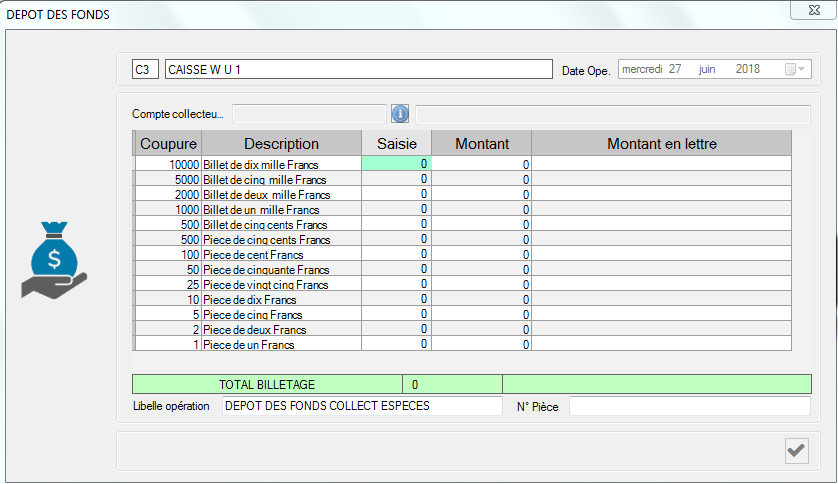

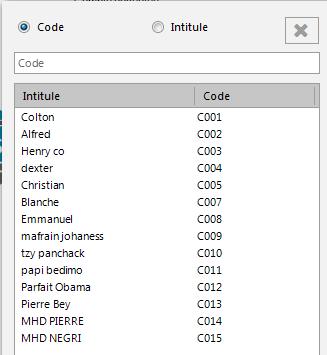

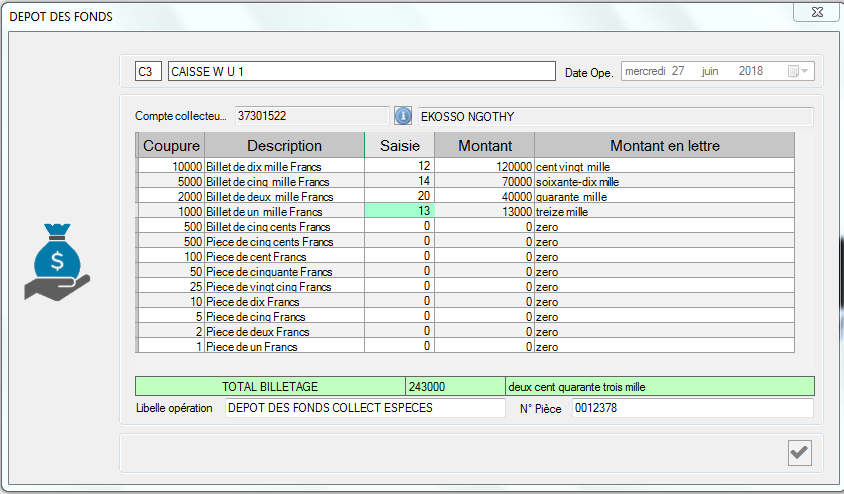

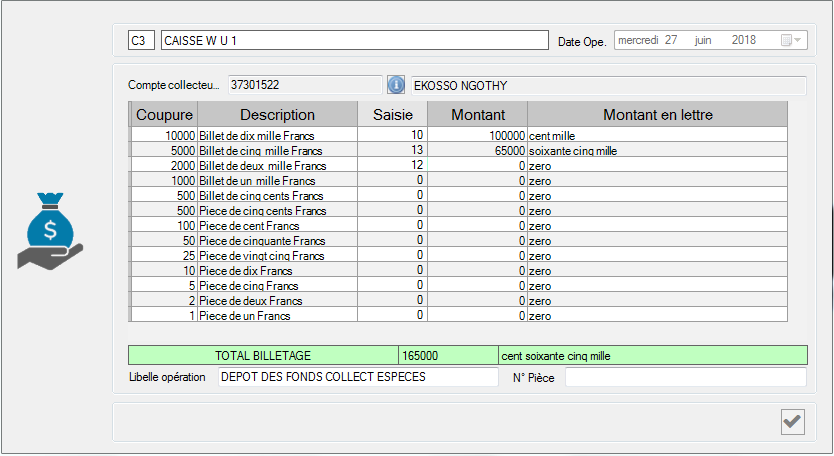

Front Office: External deposit

This form allows funds to be transferred from the collectors to the cash-desk.

The user selects the account number of the collector by clicking on the button

.

.

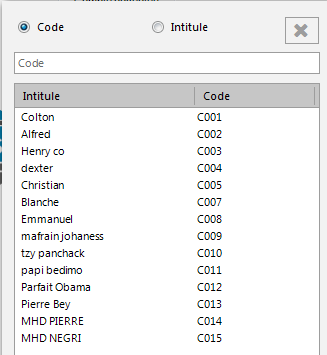

The list below is displayed:

.

.

He/she performs the ticketing, between the transaction's

wording and the number of the coin then clicks on

.

.

The system immediately performs the operation.

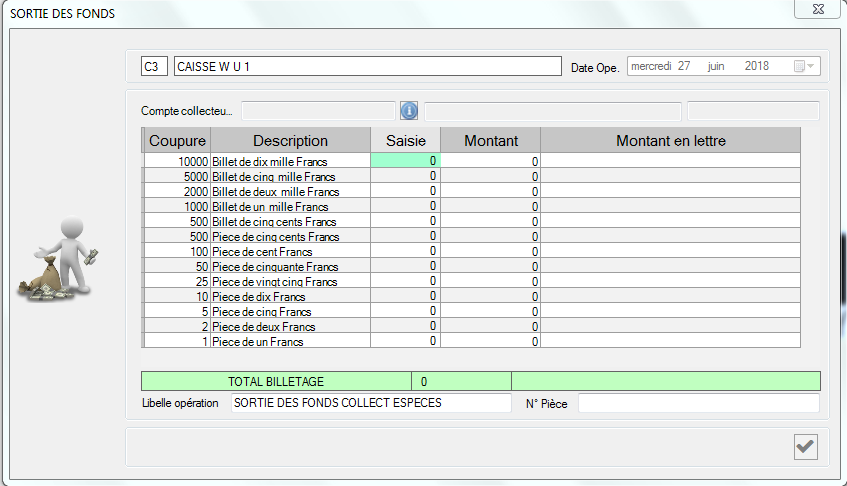

Front Office: Collector Funds Withdrawal

This form allows funds to be taken out of the cash register and

transferred to the collector's account.

The user selects the account number of the collector by clicking on the button

.

.

The list below is displayed:

He/she performs the ticketing, between the transaction's wording and the number of the

cash/coin then clicks on  .

.

.

.

The system immediately performs the operation.

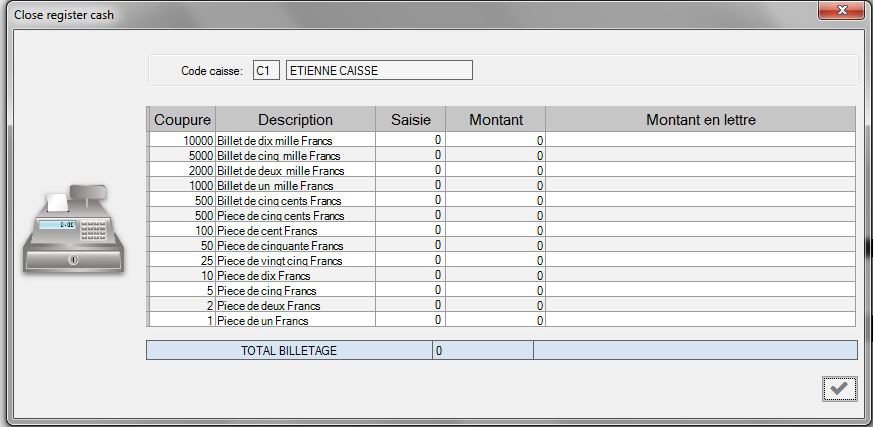

Front Office: Cash Desk closure

This section allows you to close an already opened cash register.

This form is as follows:

The user enters the ticket corresponding to his cash register.

NB: A cash register can only be closed by the user who opened it.

Click on " "

close the box. The following dialog box appears:

"

close the box. The following dialog box appears:

If the checkout is already closed, opening the form will just return this dialog box:

Back Office

This menu concerns:

-transaction entry,

-batch validation and

-account transfer.

To access it, go to the Treatment »BackOffice menu.

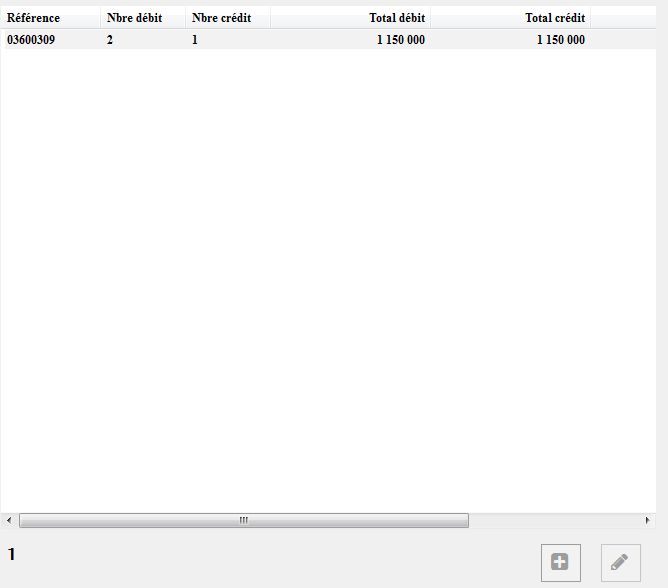

Back Office: Entering Transactions

Procedure: Processing » BackOffice » Entering Transactions.

This section deals with the entry of debit and credit transactions

in the customer's account and their registration.

This form is used to define the situation (number of debit and credit, the writing'[inputs])

of each batch entered by the user who is connected.

To enter the data concerning the operation, click on

.

.

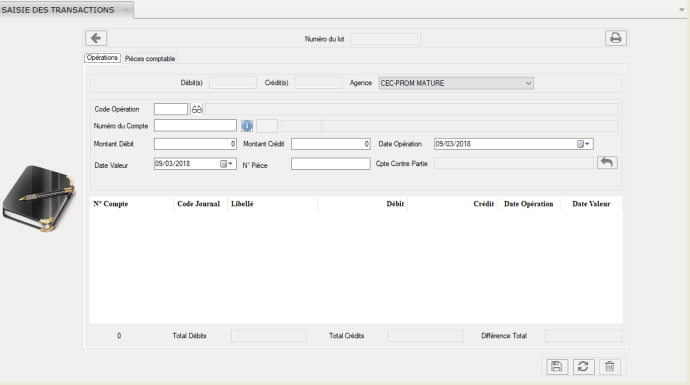

The following form appears:

This form deals with the entries and the modification.

To add a new batch(record);

-Enter the details of the transaction (code, account number, debit amount,

credit amount, the transaction date will appear automatically, value date that appears

depending on the nature of the transaction on the Account,

It can be modified as

the 'date value' of the transaction by the user after the entry,

Click on the »button to validate.

In case of error, or forgetting to write (inputs), modification or cancellation is possible.

-To modify an operation (account, or amount in the batch (record) number,

-It is necessary to select a writing, and either click on the

button, or double-click on the input.

button, or double-click on the input.

The operation appears with its elements in the text field.

You can edit and click

to save and commit the changes.

to save and commit the changes.

In case of erroneous data entry,

Cancel by clicking on the

button.

button.

To delete the data, click on

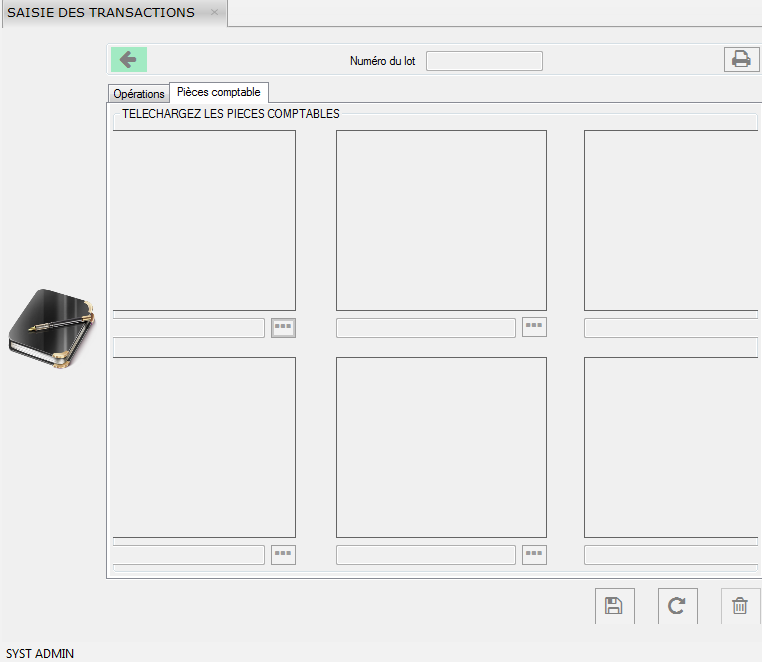

It is possible to add an accounting document to a batch (record) number,

This just by selecting the "accounting document" tab.

-To do this, click on the  "Browse" tab of the tab,

"Browse" tab of the tab,

select the image and save.

Click on  to print.

to print.

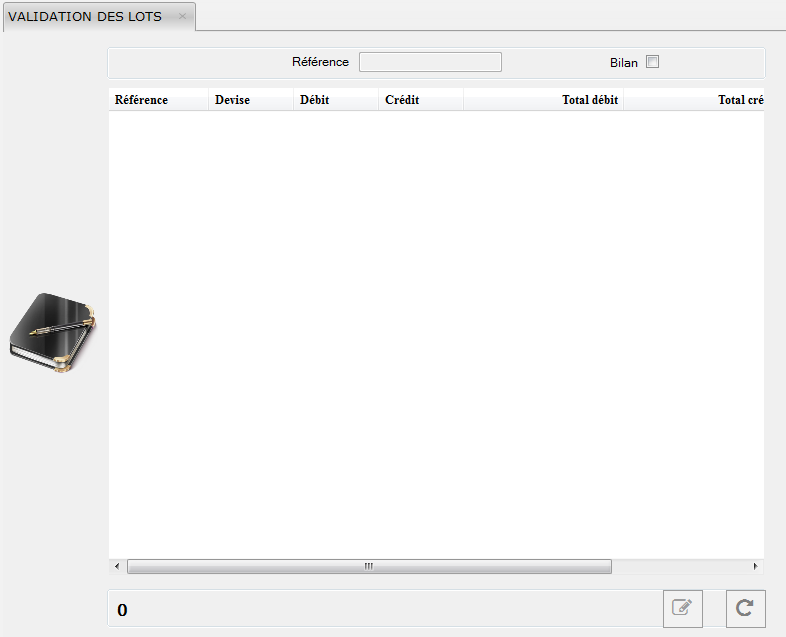

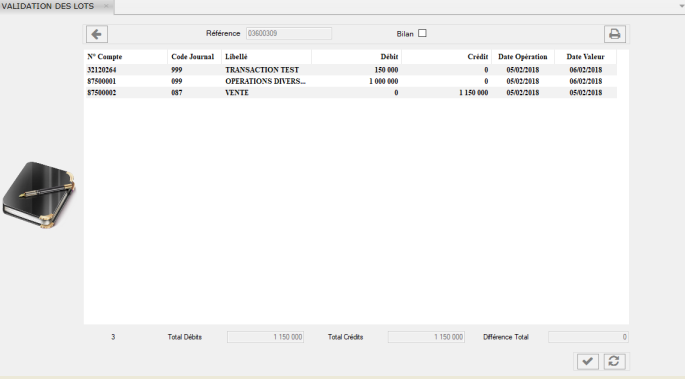

Back Office: Batch(Record or Inputs) validation

Regarding the validation of the batches (records), this sheet shows the list of entries to validate.

It is important to know that the user who entered the entries cannot validate his own entries.

The validation of an entry (input or record) is done by a user having the validation rights.

For this validation, it is necessary to select an entry (input or record), and either click on

to modify, or double-click on the batch (input or record).

to modify, or double-click on the batch (input or record).

To access the batch validation form;

go to the menu "BackOffice" »Validation of batches (input or record).

The operation appears with its elements in the text field.

You can modify and click on the

button.

button.

To cancel the entry, click on

.

.

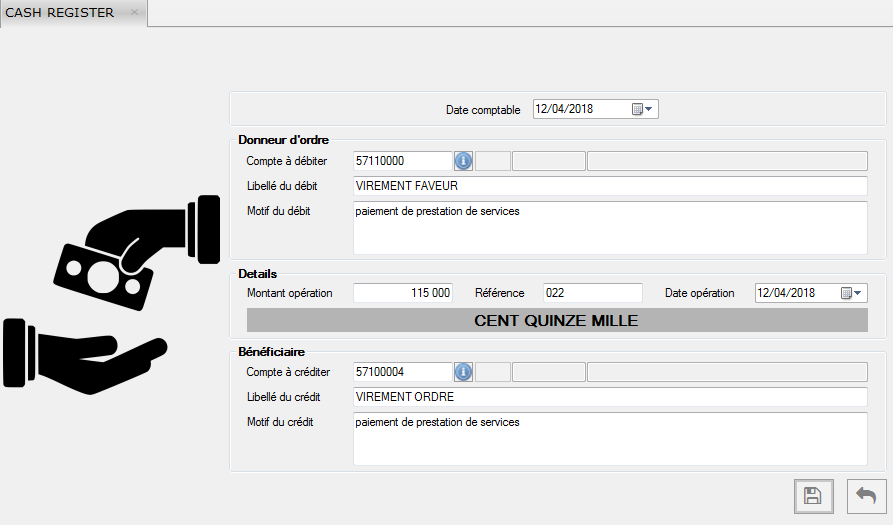

Back Office: Transfer from Account to Account

This form makes it possible to carry out a cash transfer from the account of the payer

to that of the beneficiary.

To make the transfer, click on

and fill in the form.

and fill in the form.

Click on  to save the document and

to save the document and  to exit.

to exit.

Back Office: Internal cheque book management

As indicated, this menu deals with the internal management of the checkbook held by the customer.

To access it, go to the menu Processing »Internal checkbook management.

Customization of checks

The check personalization form allows you to customize the checkbook at the customer's request.To fill in this form, you must enter the data in the various fields and click on

to save the document and

to save the document and  to exit.

to exit.

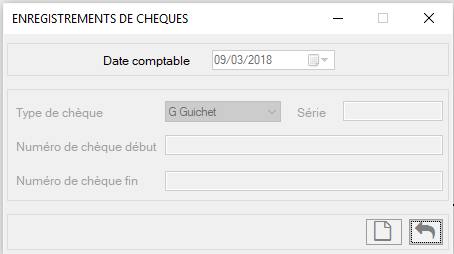

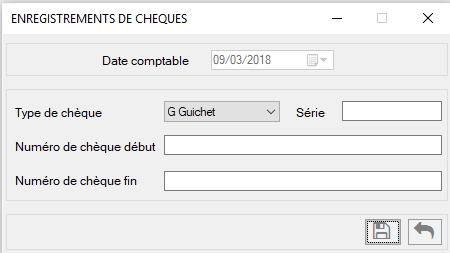

Checkbook Entry

This menu allows you to register the check according to its type and serial number.When input is disabled, this dialog box is displayed:

To activate it, click on

;

the following form appears:

;

the following form appears:

To save the checkbook, click on

and

and  to exit.

to exit.

Check situation

This section shows the situation of the checkbook at a given period.It is used to display cashed checks(checks on the cash-desk), unused checks, wickets and blocked customers if they exist.

To see this information, click on

,

, Click on

to print,

to print,

Click on

to exit.

to exit.

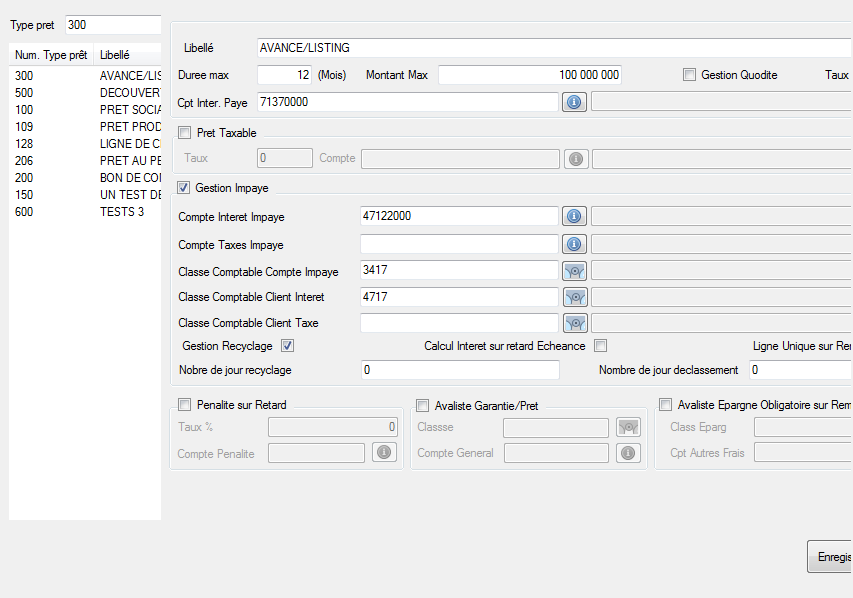

Loan Types

Note

Before entering into loan management, the agency has to set configurations for the loan type.So that any loan taken should be of a particular type and well managed.

Types of Loan

The establishment offers different types of loans.

We distinguish:

- Social loan

- The advance / listing

- The productive loan

- The discovery

- Line of credit

- Purchase order

- Staff loan

The loan form is as follows:

To choose a loan, simply select the type of loan and fill in the information concerning this loan.

Click on the "save" button and close.

You can update the saved label or track the record.

Loan Management

This menu allows you to efficiently manage loans that are in demand, those in progress or

granted to customers depending on the type of depreciation, the interest rate, the maturity

and the money back guarantee.

To access it, go to the menu

Processing »Loan Management.

This submenu has the following features:

- Loan simulation

- Loan application

- Loan Analysis

- Loan approval

- Release of funds

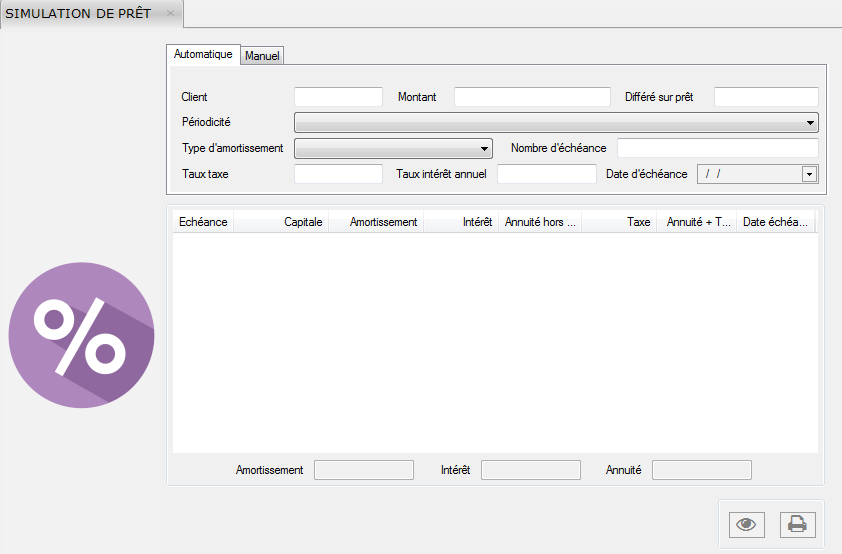

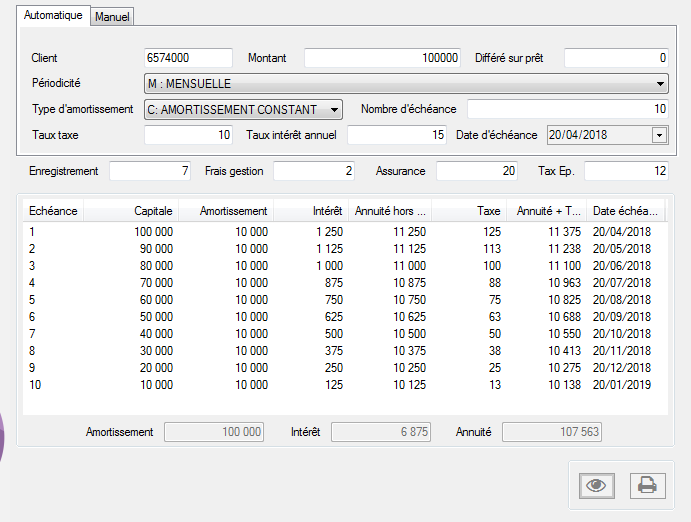

Loan simulation(Amortization table simulation)

The simulation of the amortization table allows a visualization on the loan schedule before

another is one requested.

This table calculates the amount of the loan to be repaid according

to the type of depreciation, interest rate, maturity and annuities.

The user must enter the data below:

- The customer's account number

- The loan amount

- The loan deferral(Grace period)

- The Periodicity(indicates the regularity with which the loan must be repaid);

- The type of depreciation (constant or decreasing)

- The annual interest rate

- The due date

NB: When the user chooses the type of depreciation, the number of deadlines is immediately generated and the VAT is already predefined in the system.

This form is as follows:

To see the simulation of the amortization table, click on

,

and

,

and  ,to print.

,to print.

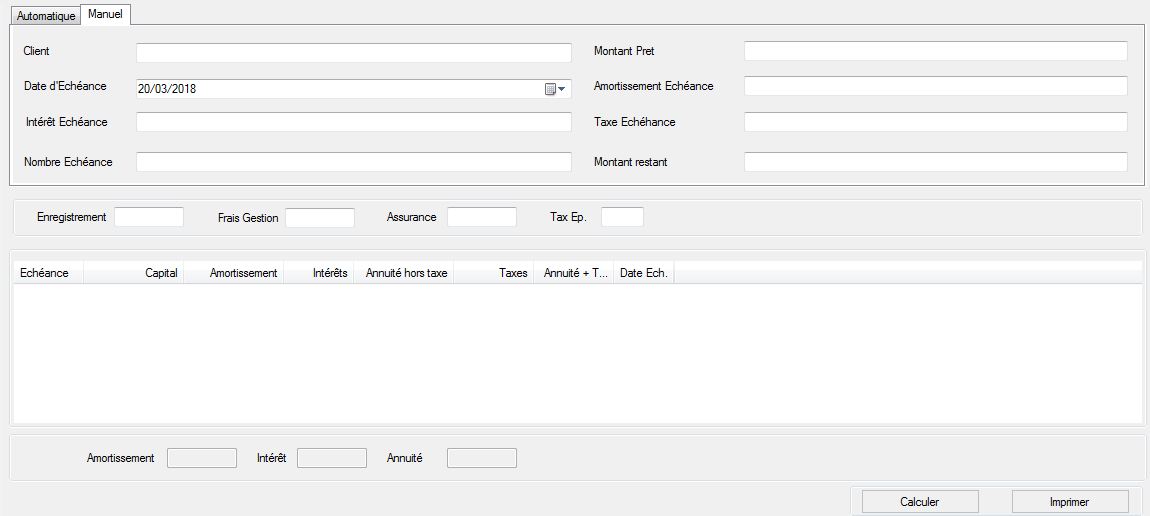

This table can also be generated manually. The manual loan application is in the same format but with some nuances(difference).

The user enters the client's name, the loan amount, and then selects the due date.

He/she enters depreciation, interest, tax and the number of due dates and the remaining amount.

To see the simulation of the amortization table, click on

,

and

,

and  ,to print.

,to print.

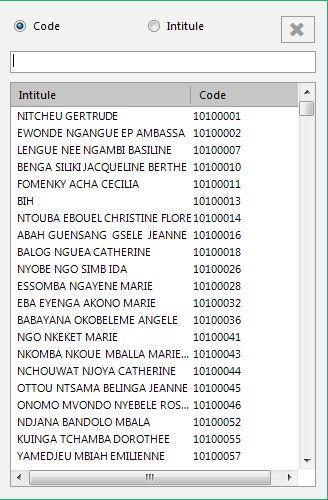

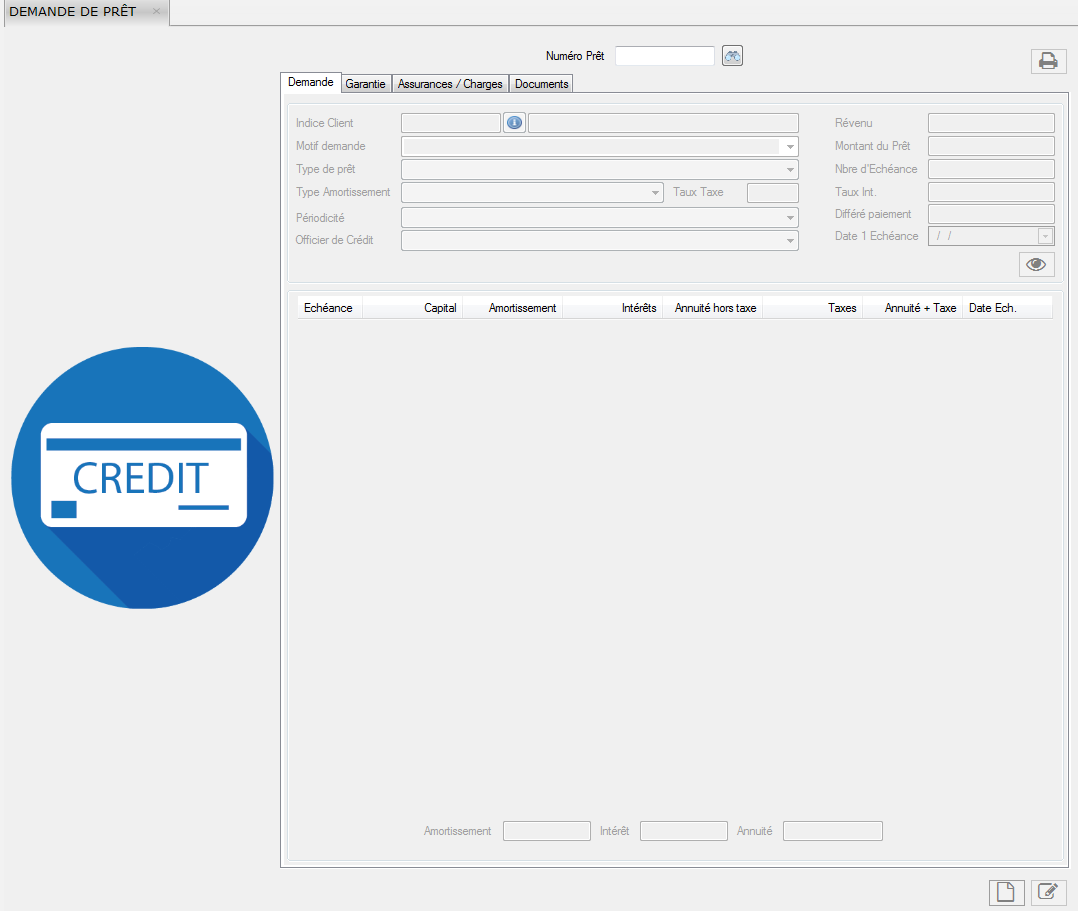

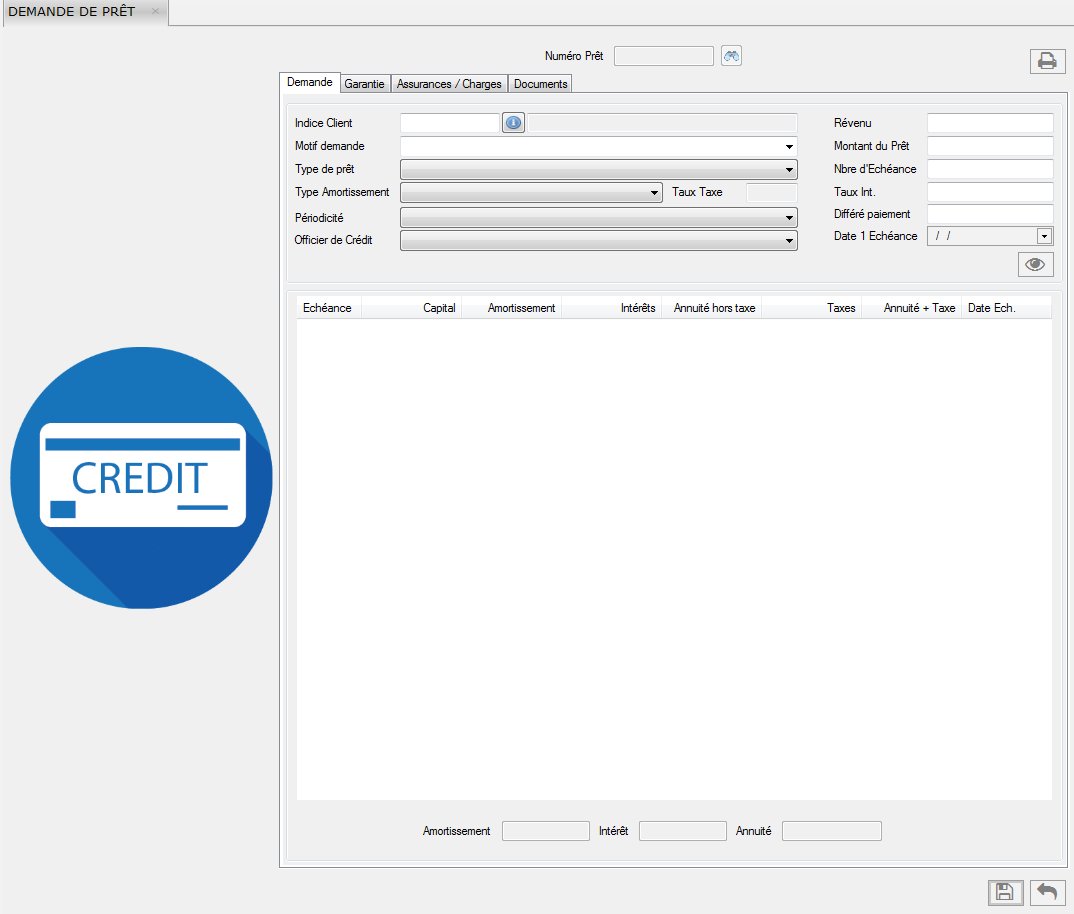

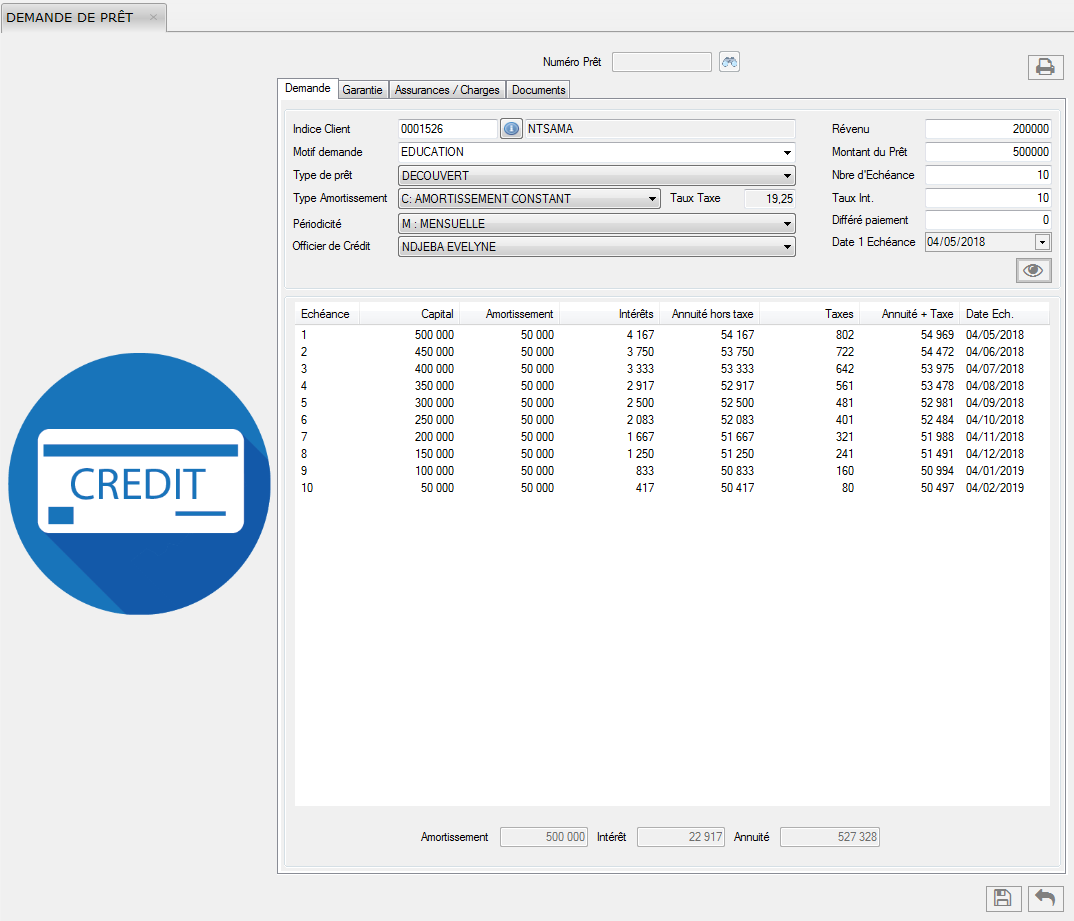

Loan Application

This sheet allows members to apply for a loan at our microfinance facility.

Obtaining a loan follows a well-defined process.

For this to be possible,

the system administrator must configure the loan request. To do this, complete the

loan application form

. It can be automatic or manual.

This automatic loan application

form is as follows:

To apply for a loan, click on

. The following form appears:

. The following form appears:

The user selects the loan number by clicking on the button and the system automatically

generates all the information requested in the sheet namely

The index and the name of the

customer,

The income of the applicant,

The reason for the loan request that the client

wishes to obtain,

The type and amount of the loan as well as the number of due dates,

The type of depreciation,

The interest rate,

The periodicity of repayment,

The deferred payment which makes it possible to know when one calculates the

amortization, maturity and the money back guarantee.

After completing the form, click on

to save and

to save and

to cancel.

to cancel.

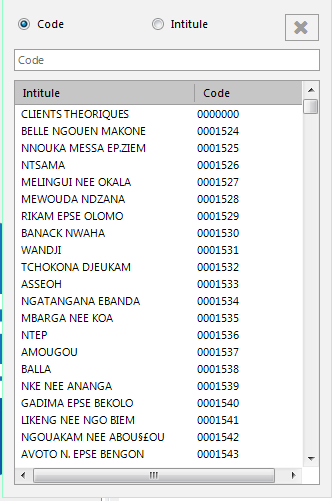

To enter the customer index, the customer must click on the

button; the list below is displayed:

button; the list below is displayed:

Double-click on the customer's name: the index and the customer's name are

automatically generated by the system in the fields provided for these elements.

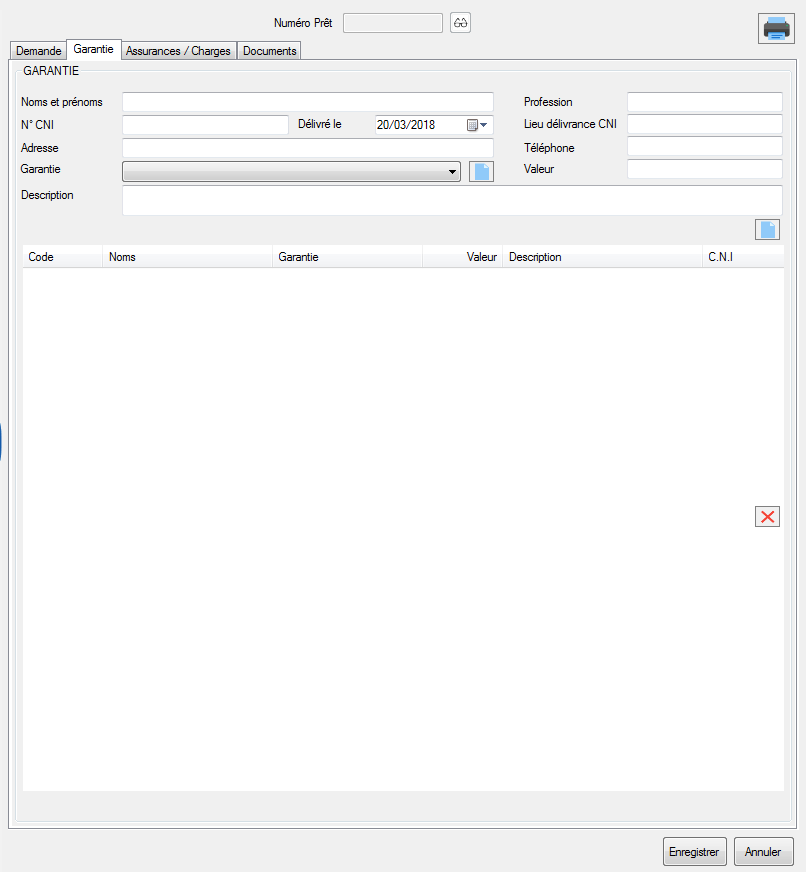

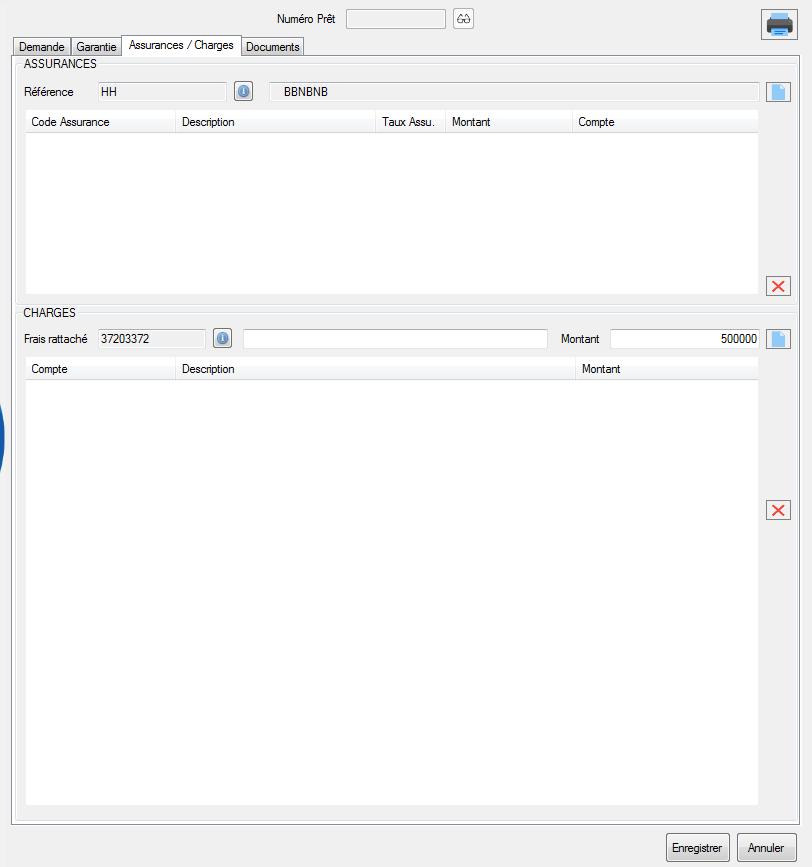

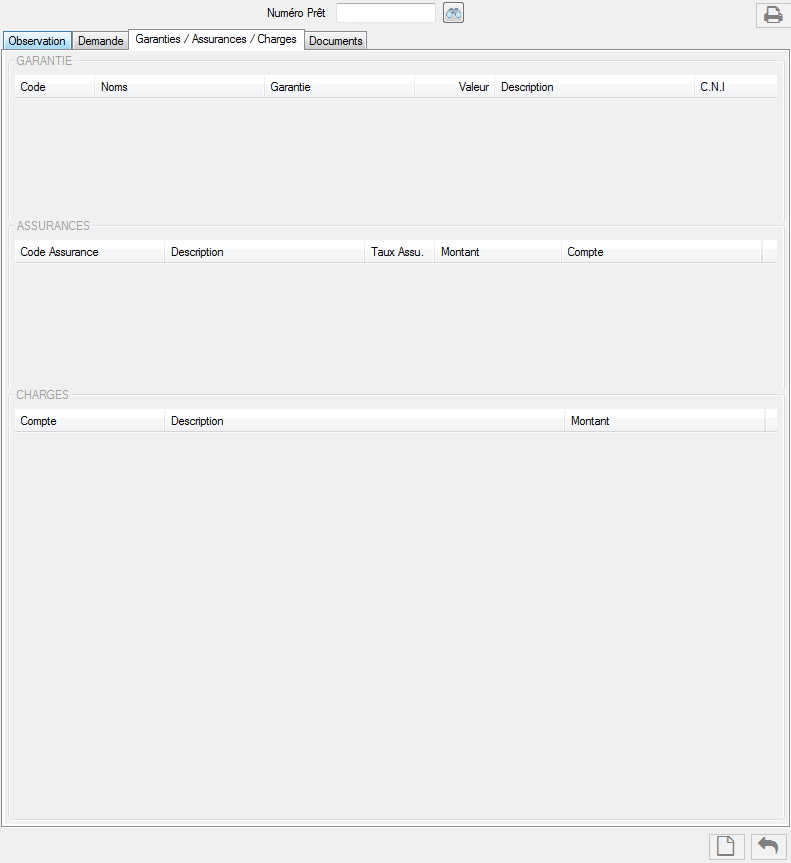

In addition to the loan application, the guarantee and insurance / expense

forms must be completed beforehand.

To print, click on  .

.

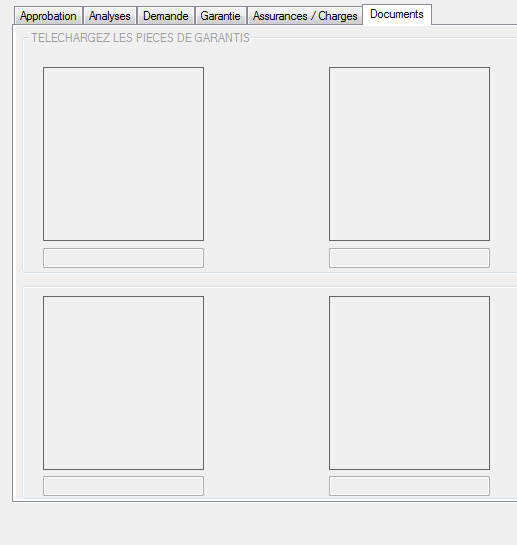

The warranty documents are downloaded from the document card.

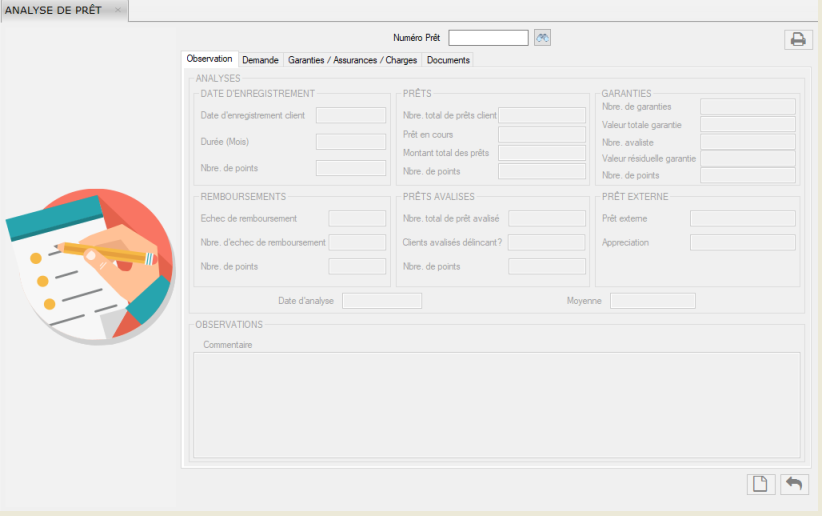

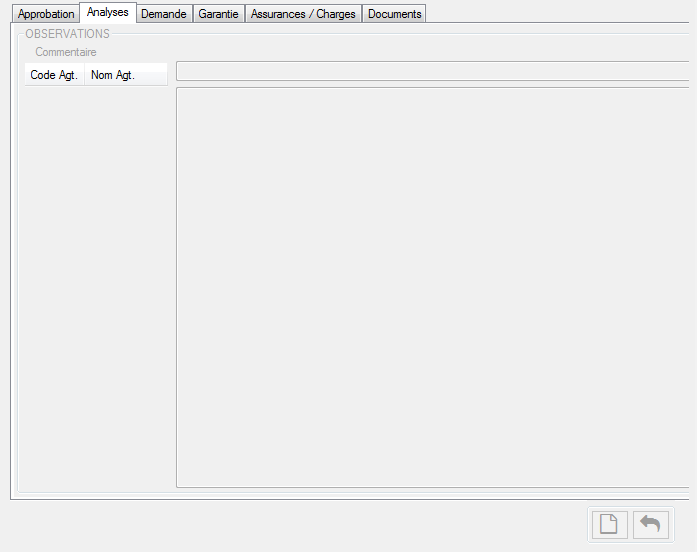

Loan Analysis

loan-analysis

This form allows you to perform a loan analysis for approval.

To access this sheet, go to the menu Processing »Loan Management» Loan Analysis.

The following observation form appears:

To enter the customer data and print it, click

and

and

respectively.

respectively.

To cancel, click on  .

.

For a new analysis, click on « ».

».

The form below is displayed:

After completing the form, click on

.

to save and

.

to save and  to cancel.

to cancel.

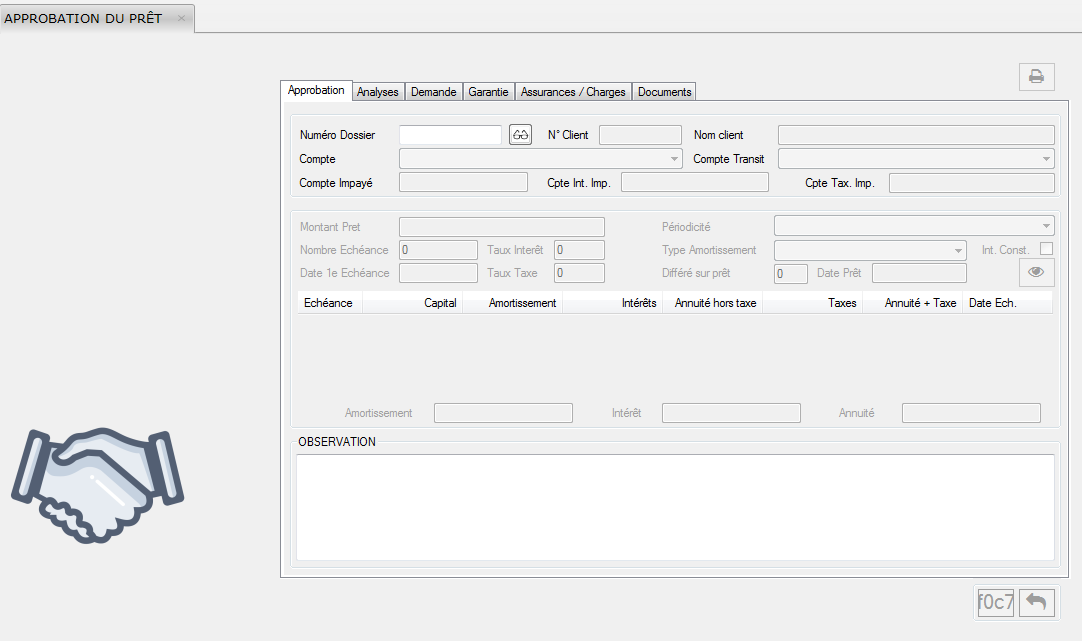

Loan Approval

The customer having made the request, it must be approved.

Just fill out the following loan approval form

After entering the data, click on the  .

button to save this data and

.

button to save this data and  .to exit.

.to exit.

In addition to the other forms, the loan approval sub-menu includes the analysis sheet

that analyzes the loan application.

It is as follows:

For a new analysis, click on

and

and

to cancel.

to cancel.

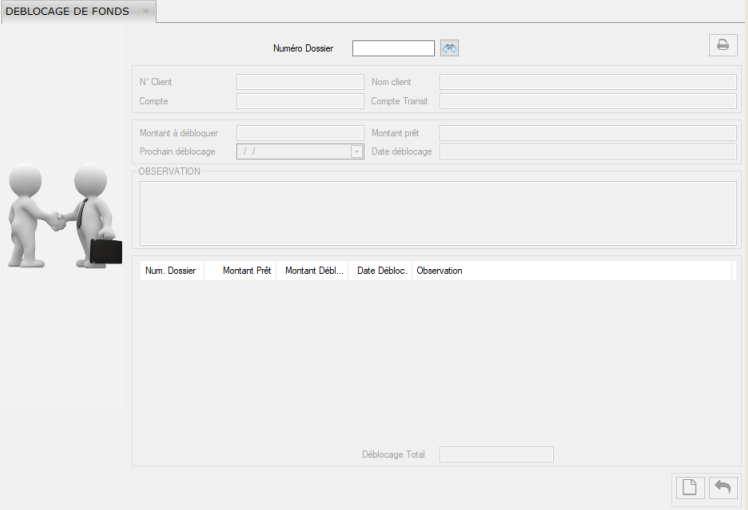

Release of funds

This submenu allows the transfer and provision of funds from the customer's account.

To access this sheet, go to the menu Processing »Loan Management» Release of funds.

It is as follows:

The user clicks on  and enters the information about the loan (the file number, number and name of the

customer, his account and the transit account, the amount to be unlocked,

the amount of the loan and the date of the next release).

and enters the information about the loan (the file number, number and name of the

customer, his account and the transit account, the amount to be unlocked,

the amount of the loan and the date of the next release).

To save, click on  and

and  to cancel.

to cancel.

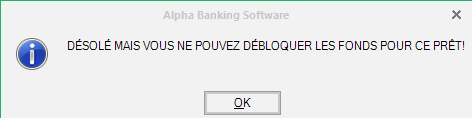

If the customer can not benefit from a loan, when entering the file number,

the system will send the message:

Cheque processing

To access this sub-menu, go to the Treatment menu »Check Processing. This menu includes the following items:

- Cheque Payment Entry

- Cheque validation

- Cheque Payment

- Situation of the customer's Cheque (Customer cheque status)

- Internal Cheque payment Entry

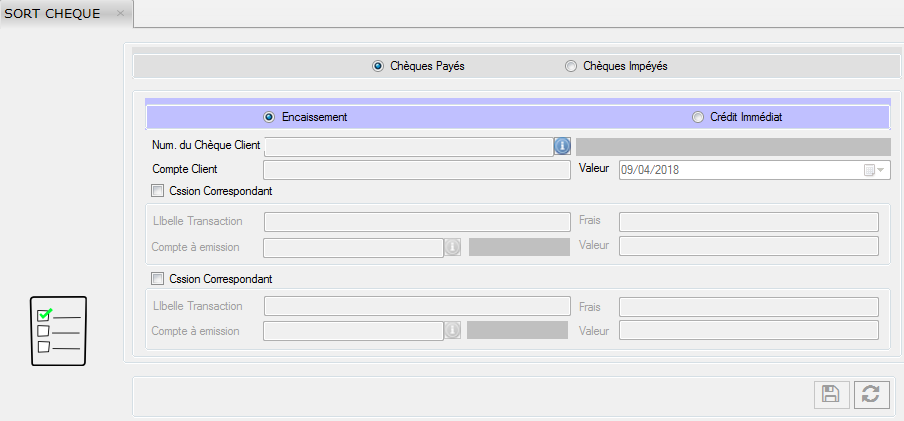

Cheque Payment Entry

This form is used to record the Cheque payment from confreres.

Microfinance receives the Cheque and verifies that the account to be debited

has the necessary funds.

The Cheque can be registered either at collection

on the cash desk or immediate credit.

1. Cashing

Procedure: Processing Cheque processing» Cheque Payment Entry »Cashing .

The receipt form allows the customer to cash the Cheque delivered to the micro-finance.

The cashing of the Cheque follows a specific process, for the cashing of the Cheque by the customer.

This sheet presents 3 parts namely:

1. The first part represents the Cheque slip.This slip contains the information on the check below:

- The date of handing cheque payment

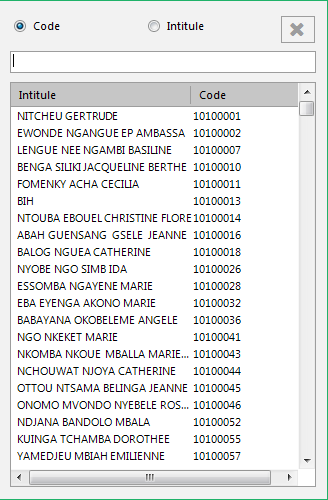

- Customer's account number (To add a customer's number, click on the button

,

,

The following list is displayed: - Name of the customer

- Billing number (To add the number of a customer, click on the button

,

,

The following list is displayed: - The date of handing over Cheque,

- Credit Account number

- Total amount of the slip

- Place of payment

- The date value

2. The second part represents the payment Cheque in question.

This sheet presents the following information:

- Cheaue number

- Client Account number of the correspondent bank

- Cheque payment Amount

- The collection (receiving) bank and its account number,

- The payment bank and its account number.

3. The third part is a list of all the cheques. This list shows all the checks issued.

It provides information on the following:

- Customer's Account number

- Cheque payment amount

- Date of the operation

- Date of value

- Customer Name

- The payment bank

- The place of payment

- The collection (receiving) bank

To enter the data, click on

.

.

The system automatically generates a list of all checks issued.

To save them, click on

.

.

To cancel the changes and refresh the list, click on

and

and

to close.

to close.

2. Immediate credit

Procedure: Processing »Cheque processing» Coresponding Cheque entry payment

»Immediate credit

This form makes it possible to cash the cheque delivered by the customer

in order to grant him the credit.

Like the receipt card, it has 3 parts:

1. The first part represents the cheque slip.

This slip contains the information on the cheque below:

- The date of handing over cheque

- Customer's account number (To add a customer's number, click on the button

,

,

The following list is displayed: - Customer Name

- Billing Number (To add the number of a customer, click on the button

,

,

The following list is displayed: - The date of handing over cheque

- Credit account number

- Total amount of the slip

- Place of payment and

- The date value

This sheet presents the following information:

- Cheque Number

- Client account number of the correspondent bank

- Amount of the pay cheque

- The collection (receiving) bank and its account number

- The bank paying and its Account number

This list shows all the cheques issued. It provides information on the following information:

- Customer's account number

- Amount of the pay cheque

- Date of the operation

- Date value

- Customer Name

- The paying bank

- The place of payment

- The collection (receiving) bank

Otherwise, the dialog box will be displayed:

To enter the data, click on

.

.

The system automatically generates a list of all the cheques issued.

To save them, click on

.

.

To cancel the changes and refresh the list, click on

and

and

to close.

to close.

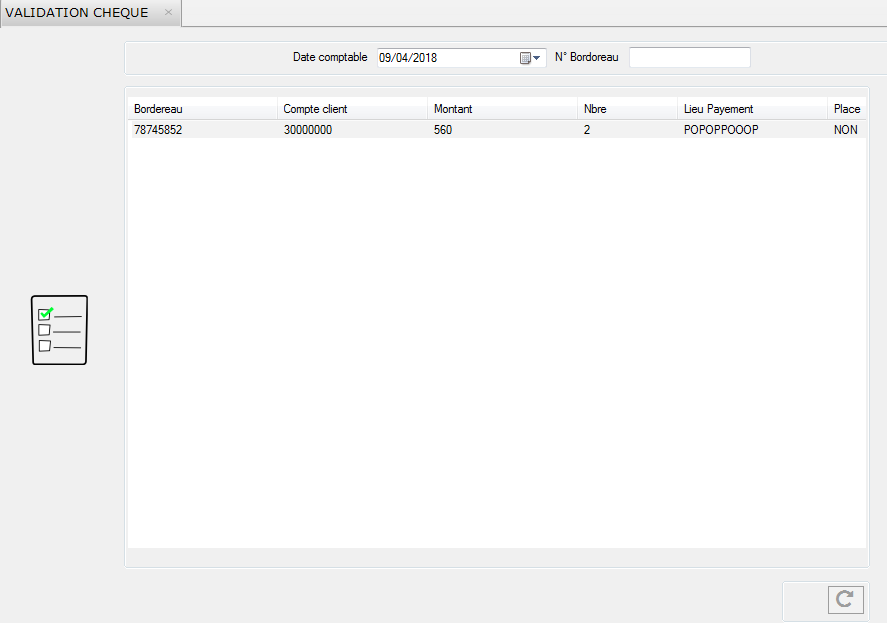

3. Cheque Validation

This form allows to see all the slips including the various cheques delivered by the

customers and to validate them.

To access this form, go to the menu

Processing » Cheque Processing » Cheque Validation.

By clicking on a slip, the system displays a list of all the cheques of the latter:

To validate a slip, the user must enter the posting date and check slip number.

To refresh the list, click on

« ».

».

4. Cheque Payment

This document shows the status of the check.

To access this form, go to the menu

Processing Cheque Processing» Cheque Payment.

- Choose the type (paid or unpaid) and the nature of the check (cashing or immediate credit).

- Enter or select the check number in the form.

To select the cheque number, click on the button Then Click on the number field.

Then Click on the number field.

The following list is displayed: - Clicking on the member's Account number, allows it to appear automatically.

- To save, click on

and

and

to cancel the entry.

to cancel the entry.

The data is generated automatically according to the check configuration.

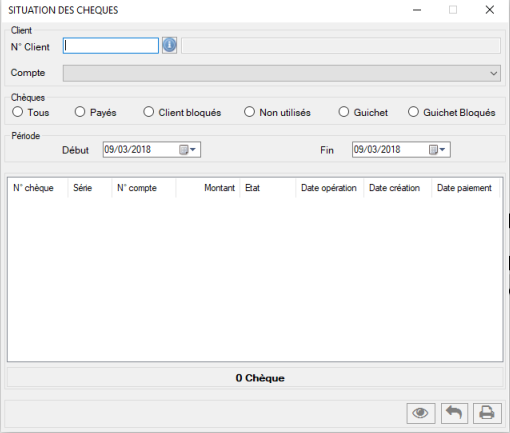

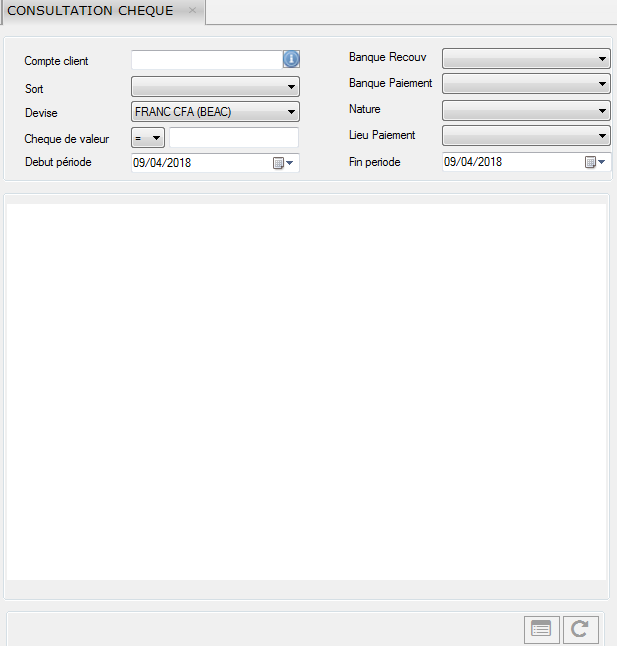

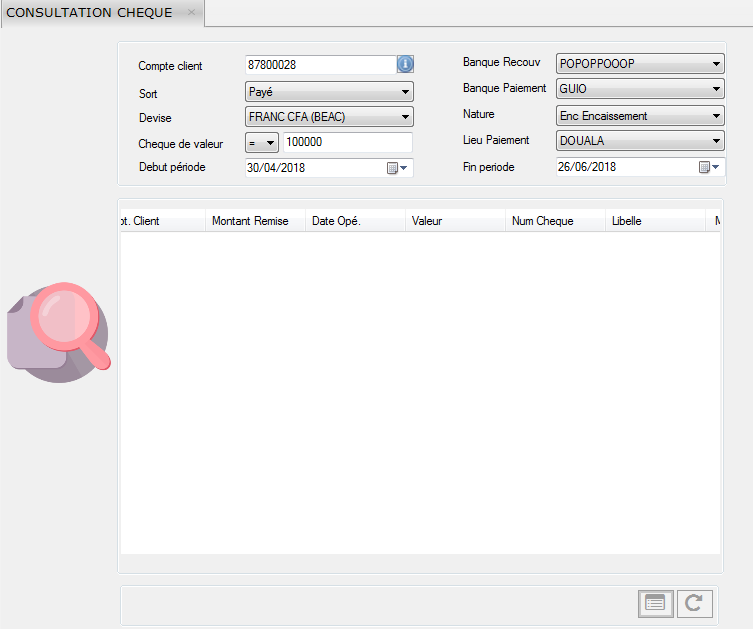

5. Customer cheque status

This form allows you to see the status of customer checks during a given period.

To do this, the user must enter the information concerning the cheque requested in the form:

Customer's Account number: To add a customer's number,

click on the button  .

Click on the number field.

.

Click on the number field.

The following list is displayed:

Select the customer Number

- The collection (receiving) bank

- The pay cheque

- The payment bank

- Currency

- The nature of the cheque

- The cheque value

- The place of payment

- The starting date

Click on

to display.

The system automatically generates the document.

to display.

The system automatically generates the document. To save, click on

and

and

to cancel.

to cancel.

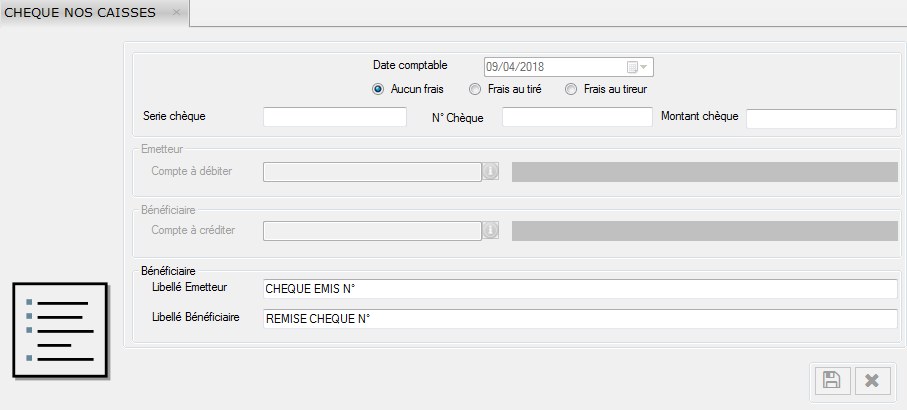

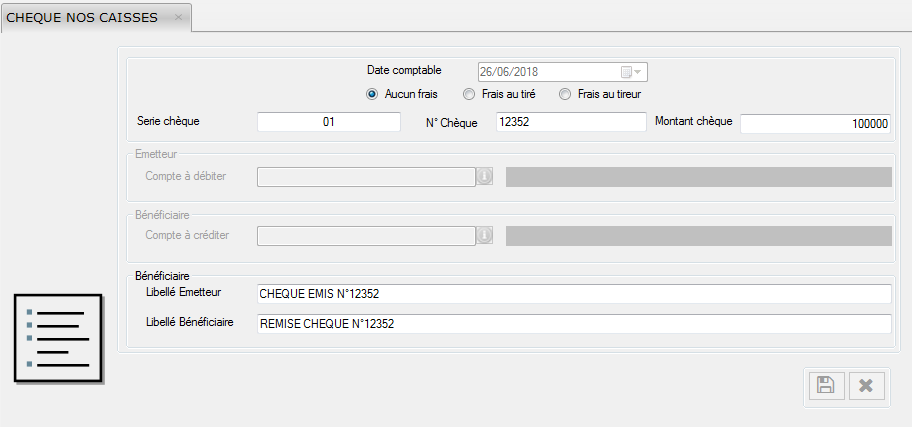

6. Internal Cheque payment Entry

This form allows you to enter the cheque issued by a micro-finance customer for

another who also has an account within the agency.

The user must enter the serial number of the check, number and the amount of

the check, the account number to be debited (issuer) and to be credited

(beneficiary) and click respectively

and

and

to save and cancel.

to save and cancel.

Updated Controls

The main novelties of Alpha are its bilingualism, its quick access by means of shortened keys.

- Keyboard shortcuts

- Alt + F: scrolls the file menu

- Alt + A: scrolls the help menu

- Ctrl + N: open the form for sending messages

- Ctrl + O: open the message import file

- Alt + P: opens the system configuration file

- F1: open the help file

- Shift + F1: open the form about

- Alt + F4: close a window

- The Bilingualism of Alpha Alpha is set of applications that can be used in either English or French. Switching from one language to another is instantaneous, this is done durig the login proress.